The decision to quit - Zillow

In November 2021, Zillow made the surprising announcement that it was quitting it’s iBuying business. The announcement was surprising due to two reasons: 1) About a year ago Zillow had announced getting into the iBuying business with a lot of fanfare, and 2) November 2021 was when companies were expected to do exactly the opposite of quitting and double down on growth and investments.

Fast-forward a year later, and Zillow’s decision to quite iBuying is likely one of it’s best corporate decision.

In one of my new favorite books on decision making, Annie Duke goes deep into the art and science of quitting. Using examples and studies from a variety of areas like mountain climbers, poker pros, and technology entrepreuners, Ms. Duke establishes the why, what, and how of the decision of quitting.

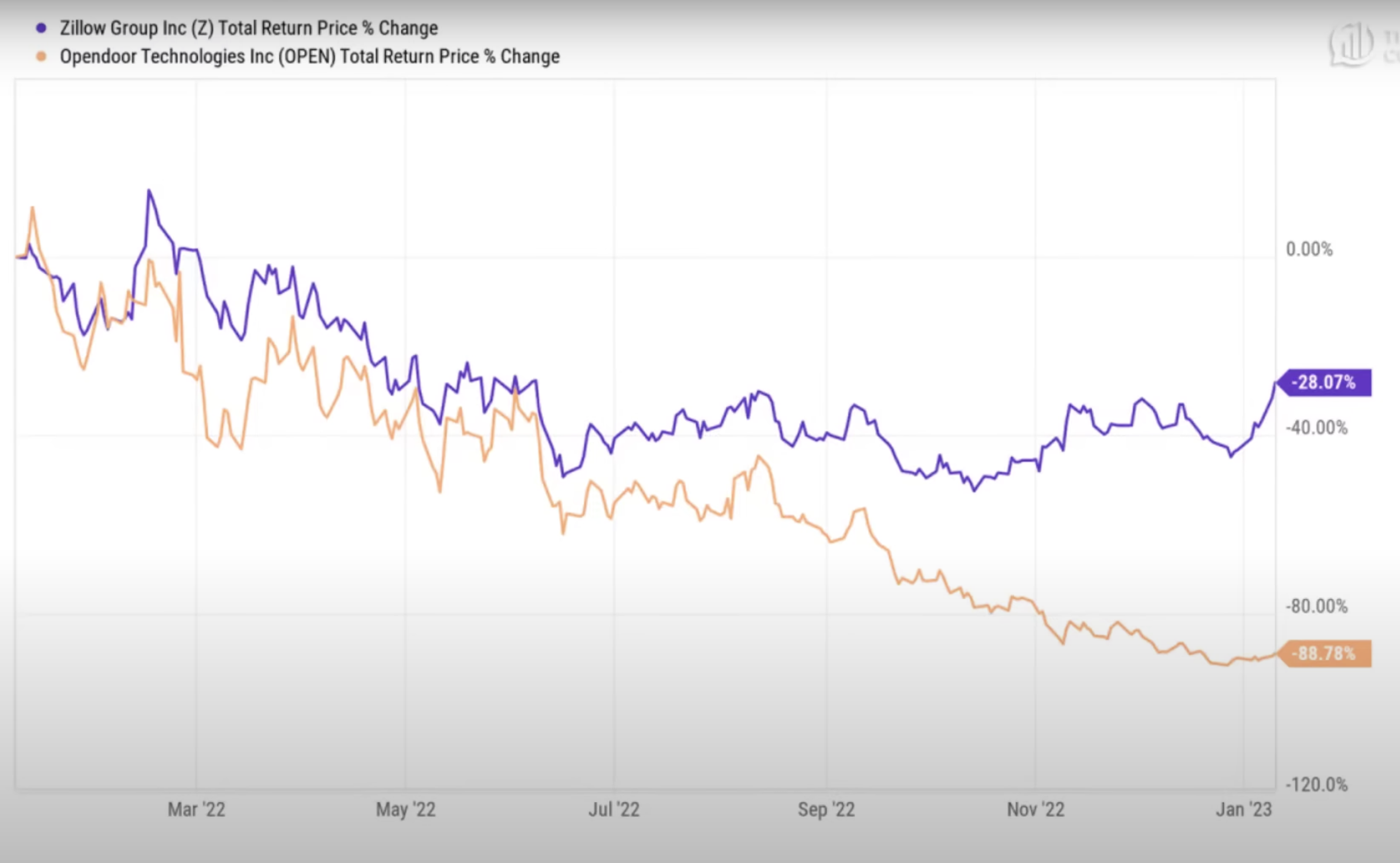

Looking at Zillow’s stock performance since that decision to quit iBuying, and comparing it to the stock performance of Opendoor, a business that stuck with iBuying (iBuying is Opendoor’s main business), it’s clear that in this case, the decision to quit has proven to be a wise reaction to the changing circumstances that Zillow came across.

Oftentimes the narrative about success tends to have a bias towards “the non-quitters”. Those who in the face of changing circumstances recklessly stuck to a decision and were successful due to a last-minute lucky draw. Success through a decision on quitting something isn’t sexy, isn’t celebrated as much. However, in investments and business, it’s not just where you decide to invest, but what decide to quit that can sometimes be the best decision.